Obviously, the first thing was to clear all my debts. Not paying interest on debts will make a huge difference to my regular budget.

Obviously, the first thing was to clear all my debts. Not paying interest on debts will make a huge difference to my regular budget.

Next was to lock away the majority of it in a long-term investment that will pay me some interest.

And then to have an "emergency fund" for those crises that in the past a credit card would have covered, things like medical expenses that I hadn't counted on and emergency trips to the vet with my animals. (No more credit cards for me.)

My son came with me for the run around to the banks, sorting things out. He made notes for me, and understands my whole financial plan probably better than I do. He says he's not looking out for my interests, he's just protecting his inheritance. My daughter's also been told all of the details. So if my cognitive function gets worse, there's people around me who know what I'm doing (even if I don't).

So that's all good news for me.

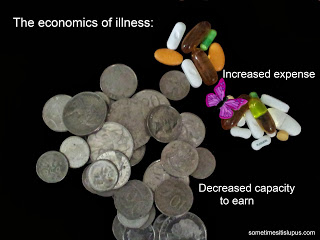

Along the way, I learned a few things that might be useful for other people who've had to give up work because of illness. (Some of which may also be helpful for people who are still working.)

When I went from working to being on a Disability Support Pension, I didn't think to notify the bank of the change. I should have. If you're on a DSP and still using a regular bank account, it's a good idea to go to the bank to change over to a specific pension account. Centrelink has a "deeming" process. They deem your savings to earn a set interest rate, and count that as your income, whether or not you actually earn that interest. In response to this the banks have set up pension accounts, which earn the "deeming" rate. This is higher than the regular savings account rate. You will need to show your pension card to get your new bank account.

It's important to ensure your bank has your Tax File Number. I hadn't even thought of this. I had a bank account long before the time when banks started collecting tax file numbers. (OK, I'm clearly getting old.) If the bank doesn't have your tax file number, it has to withhold tax from your interest at the highest possible rate.

Have a plan for what happens if you get too sick to manage your money. You need to decide who you trust to manage your affairs if you can't manage for yourself. This applies to health and personal decisions as well as financial decisions. Are you going to make a formal Power of Attorney? Are you just going to give a close family member or friend the access code and password for your on-line banking (and trust that next-of-kin will manage personal/medical choices appropriately)?

Further information:

Centrelink Deeming Rates http://www.humanservices.gov.au/customer/enablers/deeming

Australian Taxation Office information on taxation and bank accounts http://www.ato.gov.au/Individuals/Investing/Bank-accounts-and-income-bonds/

Queensland Department of Justice information on Enduring Power of Attorney http://www.justice.qld.gov.au/justice-services/guardianship/power-of-attorney/enduring-power-of-attorney