|

Pension is overly-generous and given to far too many people.

Headlines like "Disability Support Pension Burden Hits $17bn This Year" do nothing to make people think that perhaps people who need the pension are not getting it.

The idea that the DSP is out of control, and needs to be brought back into line, has been supported by three successive responsible ministers: Kevin Andrews, Scott Morrison, and now Christian Porter. Clearly with changes of minister, and even a change of Prime Minister, the Government's view on the DSP hasn't changed.

It is true that the number of people receiving the DSP has reached record levels. It's also true that the actual population of Australia has reached record levels. Add to that, that the retirement age (particularly for women) increased about a decade ago, so people have spent more time on the DSP before moving to the aged pension, and the increase is not all that dramatic.

The government has begun working on ways to reduce the cost of the DSP. In the 2014 budget, DSP recipients under 35 had their ability to work reassessed. It was planned to remove as many people as possible from the pension.

The rules for qualifying for the DSP have been tightened up, to the point where a terminally ill man was refused the pension, on the grounds that he could recover and return to work. The effort to save money by not granting the DSP has lead to the administrative cost of dealing with appeals. Ten percent of appeals have resulted in the appellant receiving the DPS.

Long before these rules were tightened, I knew a number of lupies whose doctors insisted they stop work - but who Centrelink refused the DSP to. This begs the question: when a lupie's own doctors and specialists say don't work, and the Government says you can't have DSP, how is the lupie meant to survive?

Another means of saving the government money has come from a new way the government assesses income from defined benefit superannuation funds when considering the amount of pension paid. This affects both aged and disability pensions.

The rationale behind this was that some couples were getting $120,000 per year from defined benefit funds, yet were still able to collect a pension. On the surface, that looks like a significant loophole to close - but not everyone on a defined benefit fund receives that kind of money. I receive about $6000 a year from my superannuation fund, and that has been enough to cause my DSP to be reduced under the new assessment rules. My income hasn't gone down quite as much as some other people I know of, but it will mean a tightening of my personal budget. (My personal budget is going to be more stressed, because one of my regular medications is no longer subsidised under the Pharmaceutical Benefits Scheme. The drug, paracetamol, was cut from the scheme, because it's a cheap over-the-counter medication people take once a while for headaches and minor pain, except when it's in the higher dosage everyday version for people with chronic pain.)

So the squeeze is on for people with all kinds of disabilities. Getting a pension is getting harder and harder. Keeping it isn't guaranteed. And if there's any "loopholes" out there that mean some people are getting more than their share, you can be sure it will be closed, even if it affects the people who weren't getting all that much anyway.

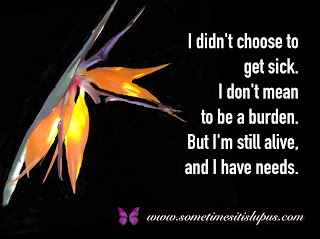

I get it. The DSP is a massive "burden" if you look at it in terms of dollars. But it's not just a matter of dollars. It's a matter of vulnerable people, people who are sick and disabled, people who in general, didn't choose to be sick and disabled. When did we cease to have value as human beings and just become a financial "burden"?

Oh, if you see a "tip jar" with a request for your loose change appear on this blog, you'll know why.

nice post

ReplyDelete